There is a peculiar phenomena in the world of business that is known as “zombie companies”. These are the kinds of businesses that appear to be in a condition somewhere between prospering and failing, neither completely successful nor completely bankrupt. In this piece, we’ll take a more in-depth look at what these mysterious creatures are, why they come into existence, and what consequences they carry for the economy as a whole. Let’s dive in and try to figure out what the heck is going on with these mysterious “zombie companies”.

What are Zombie Companies?

The term “zombie company” is used to describe a corporation that maintains its commercial activities while dealing with debt that cannot be paid off. These businesses are able to stay afloat because to exogenous forces like favorable loan rates and generous lenders. As a direct consequence of this, they balance the line between financial stability and bankruptcy.

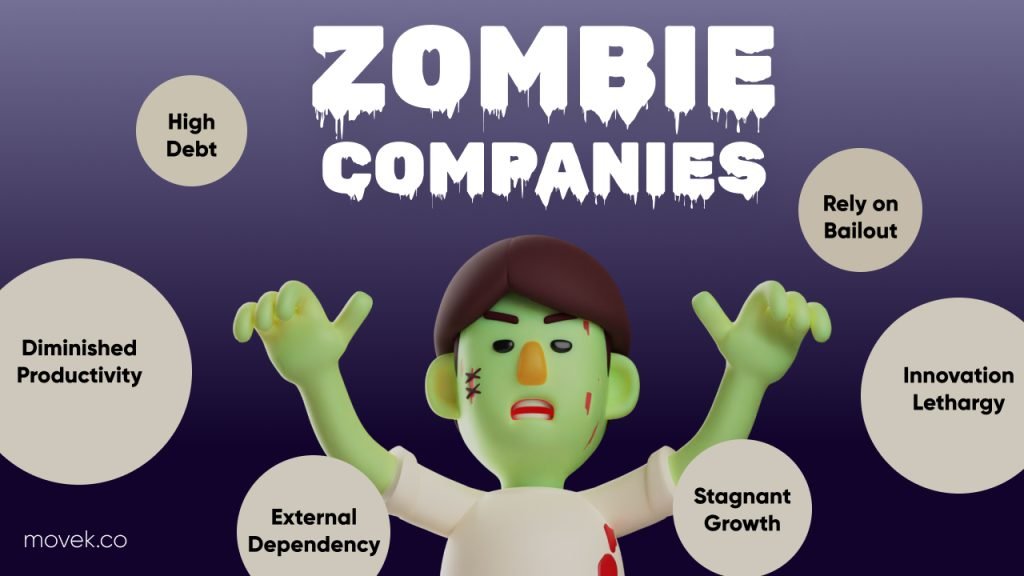

Characteristics of Zombie Companies

Zombie companies possess distinct traits that set them apart within the business landscape. These traits shed light on their unique state of existence and the challenges they face:

1. High Debt

Zombie companies often find themselves burdened with a disproportionately heavy debt load in relation to their earnings. This financial strain can hinder their ability to fulfill interest payments, creating a perpetual struggle to maintain their financial obligations.

2. Stagnant Growth

Despite enduring in the market for extended periods, these entities tend to showcase minimal growth in both revenue and profitability. This lack of progression can be attributed to various factors, including their constrained financial circumstances and limited capacity for innovation.

3. Innovation Lethargy

One striking aspect of a zombie company is its apparent lack of innovation. Stagnation in this realm prevents it from adapting to the ever-evolving demands of dynamic market conditions. This innovation deficit further contributes to the state of suspended animation.

4. Diminished Productivity

Inefficiencies and decreased production impact zombie businesses. In the absence of a driving force for operational optimization, resources are used inefficiently and performance across diverse business activities suffers.

5. External Dependencies

Survival for these companies is intricately tied to the ebb and flow of economic conditions. Zombie companies rely heavily on favorable economic circumstances and extended financial support to remain operational. The absence of these external factors could potentially tip the scales, jeopardizing their already tenuous existence.

6. Reliance on Bailouts

Zombie companies often rely on bailout mechanisms from creditors or other financial sources. This external support provides a temporary lifeline, allowing them to continue operating despite their financial struggles. However, such reliance may also contribute to prolonging their stagnant state and delaying necessary restructuring efforts.

Exploring Causes of Zombie Companies Existence

The genesis of zombie companies can be traced to a convergence of factors that weave a complex tapestry of challenges and circumstances. Delving deeper, we unravel the intricate web of causes that contribute to the rise and sustenance of these enigmatic entities:

Easy Credit Access

Zombie businesses arise in an atmosphere characterized by easy access to credit and loans with attractively low interest rates. This unrestricted borrowing may appear favorable at first, but it creates the groundwork for a risky road when debt grows beyond a company’s ability to repay.

Economic Uncertainty

Long-term economic instability, which is like a maze, is a key factor in how companies get caught up in the zombie problem. In an unpredictable environment, businesses can get stuck in a loop of never-ending stagnation, struggling to find their way through unknown waters with little room for growth.

Restructuring Aversion

Aversion to restructuring, often fueled by the fear of triggering job losses, contributes significantly to the persistence of zombie companies. Companies may resist necessary changes, inadvertently perpetuating a state of suspended animation that thwarts revitalization efforts.

Regulatory Gaps

The presence of regulatory gaps and inadequate oversight provides a lifeline to zombie companies. Weak regulations fail to prompt timely interventions, enabling these entities to persist despite their insolvency, further distorting market dynamics and hindering healthy competition.

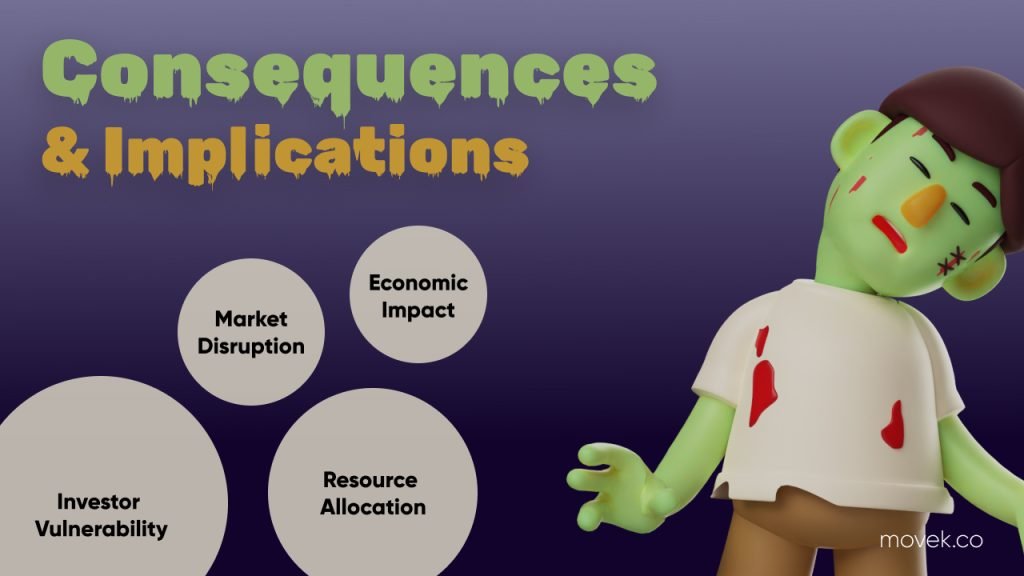

Consequences and Implications of Zombie Companies

Zombie companies have far-reaching effects that go beyond their own survival. They throw a shadow over economies, markets, and stakeholders. Let’s look at the many effects and meanings that come from the presence of these mysterious things, backed up by real facts and figures that show how important they are:

Economic Impact

Zombie companies, by consuming resources without contributing commensurate growth, serve as a drain on overall economic vitality. These entities misallocate valuable resources that could otherwise fuel innovation and drive meaningful economic expansion, hampering the potential for robust and sustained growth.

According to The Triangle the In the United States, between 5%-10% of all companies are zombie companies. This disproportionate presence impedes labor productivity growth and stifles economic progress.

Resource Allocation

Zombie companies cost money to keep going, but they also take up valuable resources that could be used for something else. Vital resources that could help start new, innovative businesses are instead used to keep these ones going. This is a missed chance to make real economic progress.

Market Disruption

The existence of zombie businesses causes disruptive rippling effects on the dynamics of the market. They undermine healthy competition by skewing the playing field and maintaining inefficiencies. Due to this distortion, industries are less likely to be revitalized by the arrival of quick-thinking and creative players.

Investor Vulnerability

Investors are on shaky territory when they invest in businesses connected to the zombie apocalypse. There is a real risk that these organizations might fail, which could result in substantial losses that ripple across investment portfolios. Investors must perform a difficult balancing act when the tides of market opinion change.

Stepping into Action

Zombie companies – caught between success and failure – present a real-world puzzle. Have you encountered these entities? Did you work in one? What signs stood out?

But here’s the twist: this isn’t just a puzzle to solve. Zombie companies impact economies and investments. What are your thoughts? How can we use resources better, encourage new ideas, and make markets fairer to build a stronger economy?

Share your ideas. Let’s crack the code on zombie companies and forge a stronger economic path together.

Latest Blogs

What is Responsive Website?

Website Performance Optimization Tips (2023)

9 Psychological Marketing Techniques to Drive Sells

Boost Your Sales with Emotional Marketing